Canada Closes Door on U.S. Dairy Farmers

photo credit: Alabama Farmers Federation, Used with Permission

John Newton, Ph.D.

Former AFBF Economist

In 2016, U.S. milk producers, competing in a global dairy market, saw the value of milk fall to the lowest level since the recession. Now, U.S. dairy producers are facing another challenge: Canada’s national ingredients strategy. Canada’s strategy, implemented at the provincial level, is designed to make Canadian milk more competitive by lowering the price of Canadian milk used to make dairy products, and subsequently, U.S. milk less competitive. This strategy is now displacing many U.S. dairy farmers and businesses accustomed to supplying the Canadian market with ultrafiltered milk.

Ultrafiltered Milk and Canada

Milk is composed of butterfat, protein, other milk solids and water. The standard composition of milk is 3-4 pounds of fat and approximately 3.5 pounds of protein per 100 pounds of milk. Milk is 87 percent water. Ultrafiltration is a process that separates these milk components based on the size of the membrane, retaining the milk proteins while allowing for the lactose, water, and other minerals to pass through. The final product is a concentrated dairy ingredient with higher protein levels that can be used as a substitute for traditional milk in cheese making.

To support its domestic dairy market Canada maintains strict tariffs and import quotas and administers a milk supply management system. In Canada, raw milk that is sold to processors is classified and priced based on end use. The classes range from fluid milks and creams (Class 1) to milk used for further processing (Class 5, also known as the special classes). The price of milk in the special classes is based on international dairy commodity prices.

A result of Canada’s dairy policies is that the price of Canadian milk is typically higher than the price of milk in the U.S. This price difference between U.S. and Canadian dairy and milk products, along with the U.S. proximity to Canada, made U.S.-produced milk proteins a competitively priced input for Canadian cheese processors.

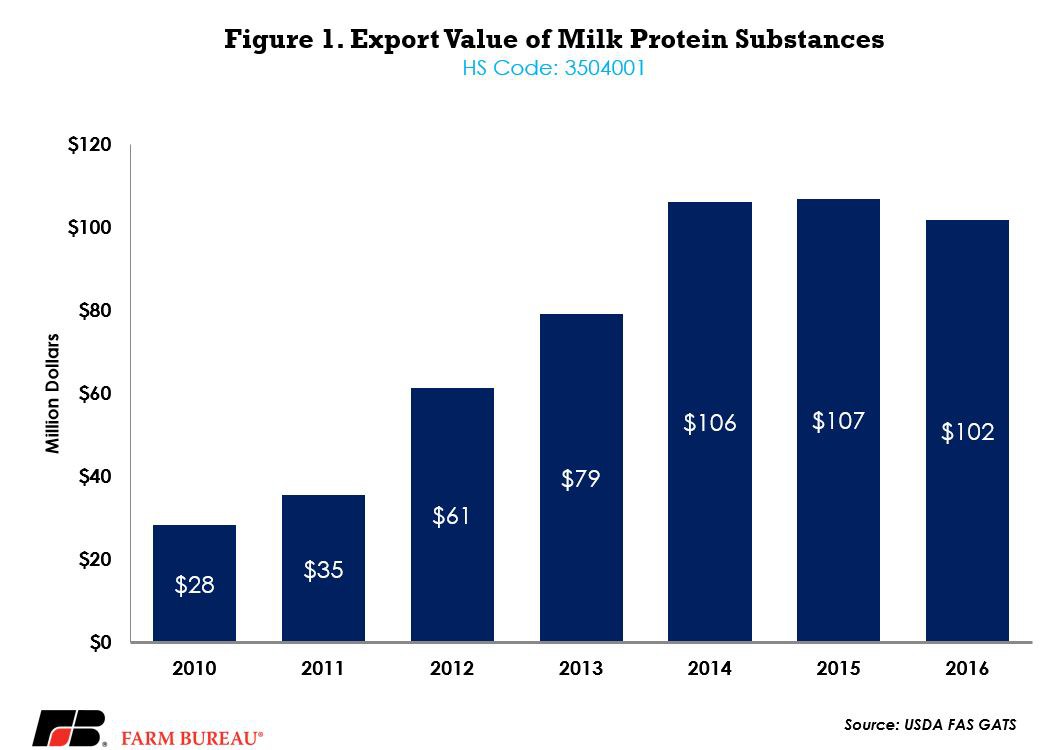

U.S. dairy farmers and processors responded to this demand that emerged several years ago by making multi-million-dollar plant investments and expanding production and export volumes of these milk proteins. USDA trade data reveals that in 2010 the U.S. exported $28 million of milk protein substances to Canada. By 2014, this total had grown to more than $100 million in annual exports. From 2010 to 2016, the value of these exports totaled more than $500 million, Figure 1.

Canada recognized the issue several years before volumes increased significantly. In 2008, Canada created a new quota on these milk proteins and effectively limited the market access to 10,000 metric tons per year. However, due to the North American Free Trade Agreement, that quota could not be applied to U.S.-produced ultrafiltered milk.

The national ingredients strategy is in response to the growth in imports from the U.S. Canada begin pursuing development of this strategy in late 2015. By April 2016, according to the Ontario Regulatory Registry, Ontario implemented a new Class 6 milk pricing program that “will include skim milk solids in all forms that can be used as ingredients, including but not limited to skim milk, skim milk powder, ultrafiltered and diafiltered milk, whole milk powder and condensed or evaporated milk (not for retail).” The price for this milk is based on international prices of milk products, effectively dropping the price of milk to Canadian processors, and in doing so severely cut into this well-established market for U.S. milk protein substances.

Canada then continued to build on this approach by translating it into a national program. The agreement to pursue that national path was reached in July 2016 when the national ingredients strategy was announced. The provincial governments of Canada adopted the program earlier this year.

Impact on U.S. Dairy Farmers

As a direct result of the lost export opportunities, some U.S. dairy manufacturers recently communicated to their dairy farmer suppliers that they had lost business in the Canadian market. In at least one company’s case, as many as 75 of their dairy farmer suppliers will no longer have their milk supply agreement beginning May 2017. These farmers need to find a new marketing arrangement or processor for their farm milk. Finding a home for this displaced milk is proving to be a tall order as the U.S. milk supply continues to outpace processing capacity in some regions.

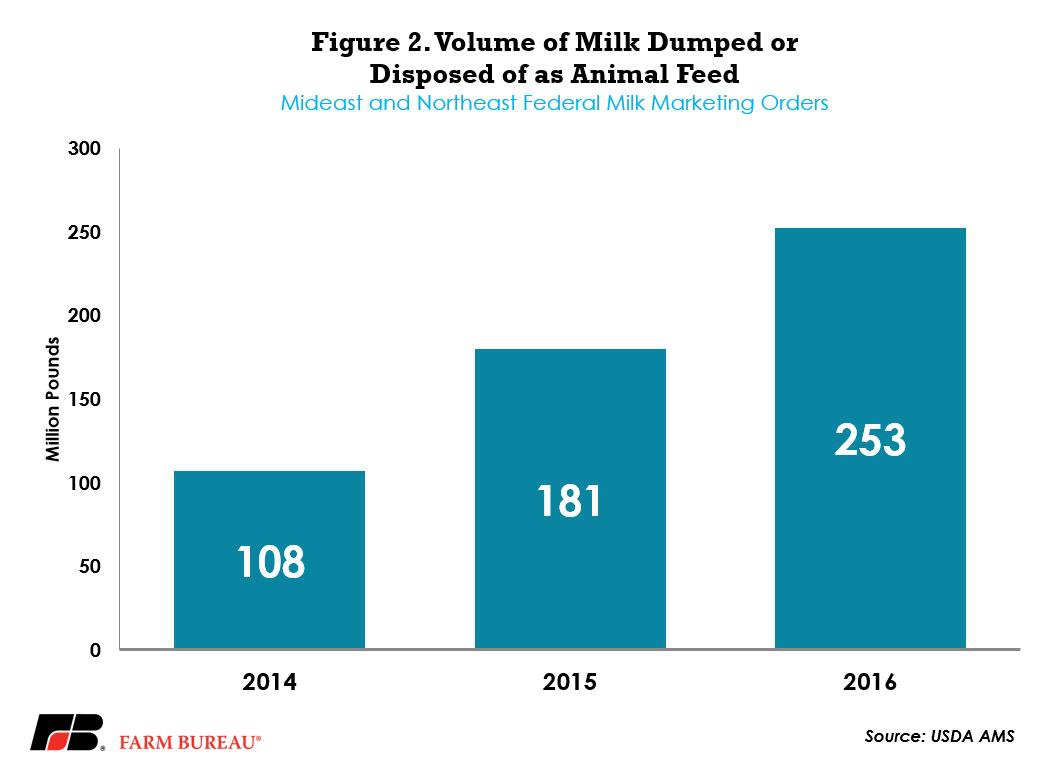

In 2016, U.S. milk production increased 1.8 percent to more than 212 billion pounds. However, in some of the largest milk producing states like Michigan (+6.1 percent), Wisconsin (+3.8 percent), and New York (+4.7 percent) the growth in milk production was even larger. This additional milk coming online during the spring flush exceeded processing capacity in these areas and hundreds of millions of pounds of milk were sold at steep discounts, dumped, or used as animal feed, Figure 2.

The trend of dumping milk is continuing this year as USDA recently authorized the pooling of dumped milk through May 2017. Despite the processing constraints USDA projects milk production to increase by more than 2 percent, or five billion pounds, over 2016 levels to a record 217.3 billion pounds. This reality makes it particularly challenging for farmers to find a new processor for their milk during spring flush.

Dairy cooperatives may re-blend prices among their farmer members to minimize the impact of the dumped or heavily discounted milk. Through this price re-blending, all cooperative members share the burden of balancing the market through lower milk prices. Milk processors receiving milk from independent milk producers do not have this price flexibility and must pay Federal Milk Marketing Order minimum prices to milk producers. In scenarios where a plant loses a key customer or market, the milk from the independent producers cannot be sold at a discount or dumped without the milk processors absorbing significant financial losses.

Last year, the U.S. lost 1,725 dairy farms due to surging milk supplies and lower dairy commodity prices. The U.S. could lose more operations in 2017 due to the lost market opportunity presented by Canada’s national ingredient strategy.

Canada’s milk pricing scheme and its impact on U.S. dairy farmers has been brought to the attention of the Trump administration. Stakeholders are also working to find processors for the displaced milk and have requested USDA purchase dairy products and absorb them into nutritional aid programs. Longer term, until new processing facilities come online the U.S. will struggle to balance the increasing milk supply with demand. New market opportunities (e.g. new negotiations with key markets like Japan, China, and Vietnam to replace the previous Trans-Pacific Partnership) and improvements in existing trade agreements are necessary to grow demand for U.S. dairy products as well as provide for stronger trade dispute settlement mechanisms.

Trending Topics

VIEW ALL