Are ‘Beans In the Teens’ Possible?

TOPICS

WASDE

photo credit: Arkansas Farm Bureau, Used with Permission

John Newton, Ph.D.

Chief Economist

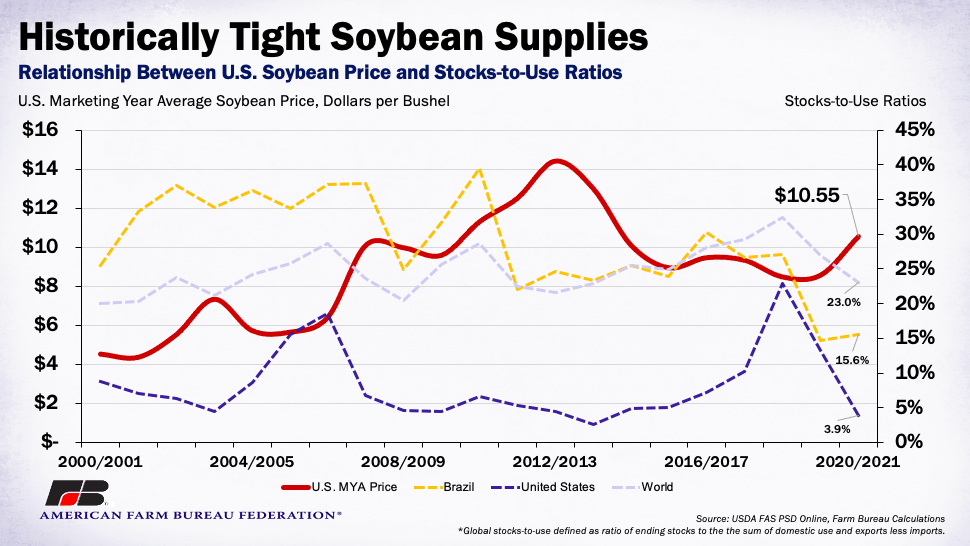

Over the last two years, soybean exports and domestic crushing have outpaced soybean production in the world’s leading soybean-producing nations, Brazil and the U.S., helping to draw down their collective inventory by an estimated 1.2 billion bushels. Now, in advance of the highly anticipated January World Agricultural Supply and Demand Estimates report, we’re looking at the tightest soybean market in six years, with global stockpiles of 3.1 billion bushels and a stocks-to-use ratio of 23% -- the lowest since the 2013/14 marketing year.

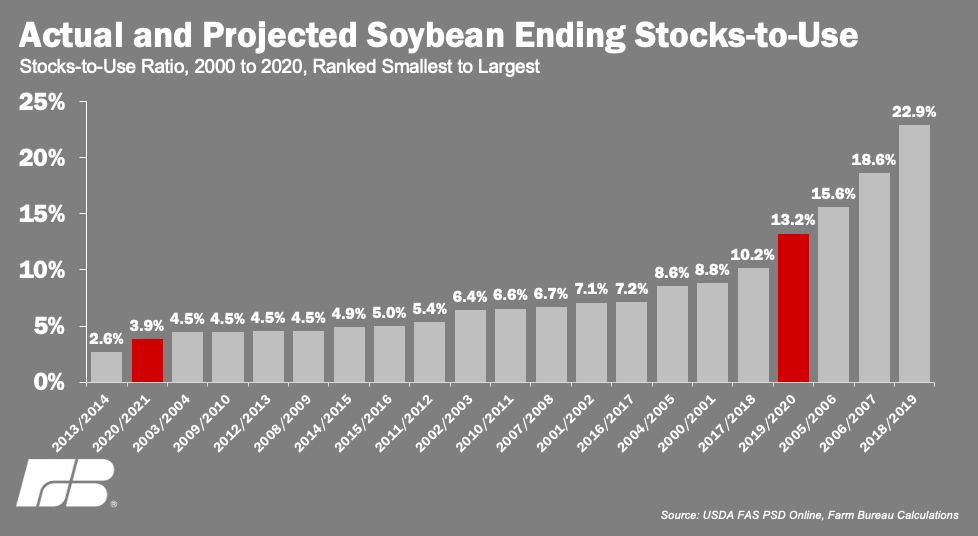

Tight U.S. and Brazilian Supplies

Currently, U.S. soybean ending inventory is projected at 175 million bushels, with a stocks-to-use ratio of 3.9%, again, the lowest in six years and the second lowest in more than two decades. Similarly, Brazilian ending stocks are projected at 761 million bushels with a stocks-to-use ratio of 15.6%, up from the prior year, but the second lowest in more than two decades. On the back of these tight soybean supplies, the U.S. marketing year average soybean price is projected at $10.55 per bushel, the highest since 2013’s $13 per bushel and well above early growing season expectations of $8.20 per bushel (May 2020 WASDE).

These historically tight supplies come in advance of the January WASDE, which is expected to show increased U.S. soybean export projections and potentially lower South American production given recent dry conditions during the growing season.

Evaluating U.S. Soybean Exports and Ending Stocks

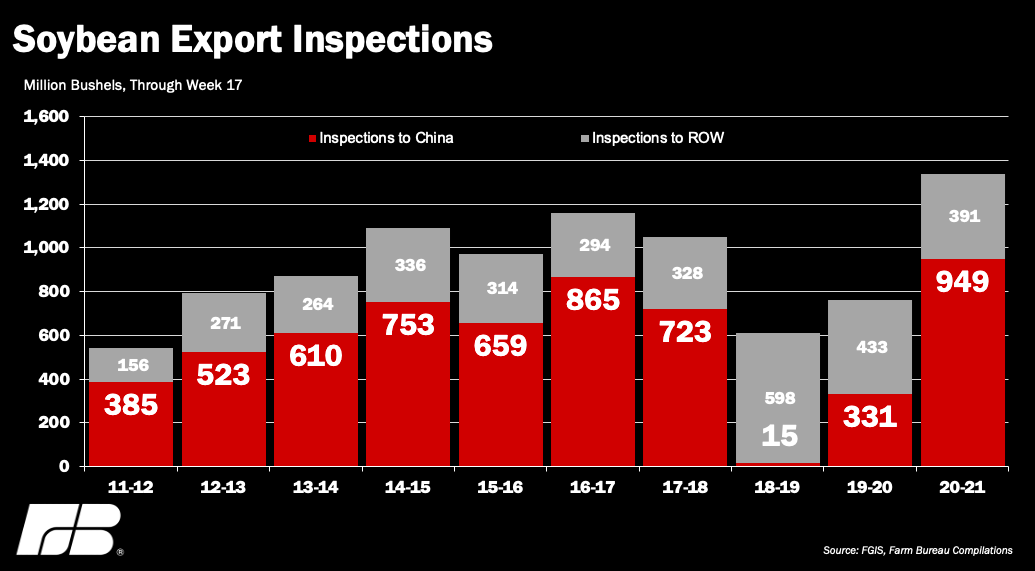

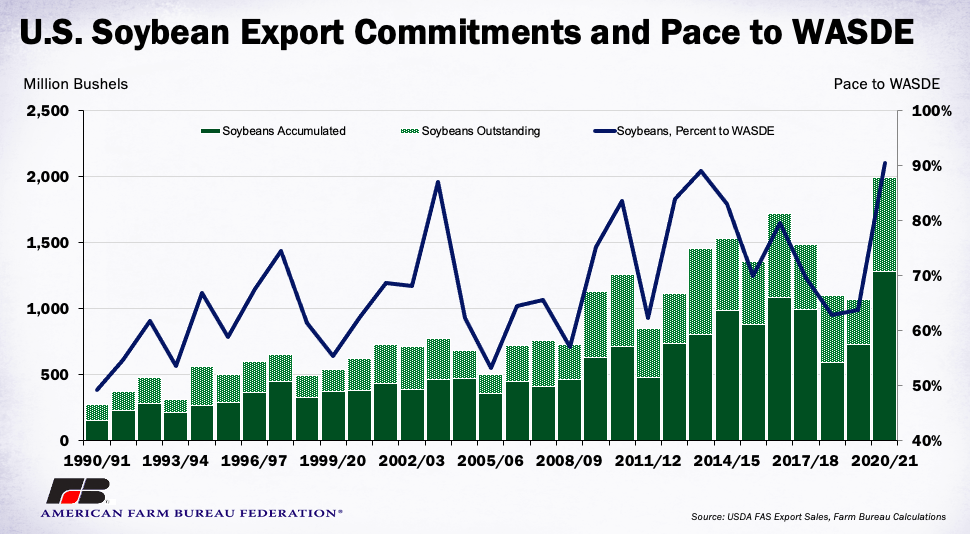

Staying in the U.S., current Federal Grain Inspection Service data reveals U.S. soybean export inspections through the week ending December 24 at 1.3 billion bushels, approximately 61% of the December WASDE export projection of 2.2 billion bushels. The average pace to meeting WASDE projections at this point during the marketing year, before the retaliatory tariffs by China, was approximately 52%. Should that pace hold, a reasonable expectation for soybean exports during the current 2020/21 marketing year could be in the 2.6 billion bushel range – 400 million bushels higher than the current projections, and given current carryout levels, 225 million bushels higher than our projected ending stocks.

Another measure of soybean exports, USDA’s export sales report, shows total soybean export commitments through the week ending December 17 at a record 1.99 billion bushels, approximately 201 million bushels below the current WASDE projections. Current export commitments represent 90% of the projected WASDE total. Given that the average over the decade before the trade war was 75% to WASDE as of the 16th week of the marketing year, the current pace suggests soybean exports could reach as high as 2.6 billion bushels. Again, this would be a stretch given the current ending stocks level of 175 million bushels. However, any adjustment to soybean exports greater than 55 million bushels, while holding all else constant, would result in an ending stocks level of fewer than 120 million bushels and the lowest stocks-to-use ratio in more than 2 decades.

Summary

On the back of strong Chinese demand ($6.8 billion in soybeans purchased in October and November) U.S. soybean export commitments are record high. Following a short crop year in 2019, the U.S. is on pace to see the smallest soybean carryout and stocks-to-use level since 2013. This, in turn, is expected to lead to the highest marketing year average soybean price since 2013, $10.55 per bushel.

For bulls, any increases in soybean demand in the upcoming January WASDE, holding all else constant, could push soybean stocks-to-use levels to their lowest percentage in decades. In anticipation of the January report, soybean futures prices have sharply rallied in recent weeks and are approaching $13 per bushel.

Bears will point to the downside: With higher prices comes the possibility of canceled export sales. While many buyers may lock in prices in advance, current outstanding sales of soybeans are a record 708 million bushels, leaving open the door for buyers to walk away from high-priced and unhedged soybeans. That, of course, would push stockpiles higher, holding all else constant. Additionally, should South America receive much-needed rainfall in the coming weeks or the port strike in Argentina comes to an end, the demand for U.S.-sourced soybeans could be reduced – again driving prices lower and ending stocks higher.

What’s certain is that all eyes will be on the January 12 WASDE. Good news will surely lead to beans in the teens in nearby months.

Top Issues

VIEW ALL