Analyzing Farm Inputs: The Cost to Farm Keeps Rising

TOPICS

Market IntelShelby Myers

Economist

photo credit: Jason Fellows, Used with Permission

Shelby Myers

Economist

Production costs are rising faster than commodity prices, making it harder to just break even

Like any other business, farmers and ranchers are constantly evolving their budgets. For farms, the constant attention to detail becomes particularly important in times of high volatility, like we have today, and occurs both on the revenue and cost sides of the business. Regularly evaluating budgets helps farmers to anticipate expected profits or losses and to consider risk management tools in the event of crop damage or revenue decline. This Market Intel article is part of a series that dives deeper into the rising prices of farm production expenses like fertilizer, seed and pesticides, energy, machinery and land that are pushing farmers further away from breakeven and questioning how they will make ends meet for the 2022 growing season and even into the 2023 season.

Revenue

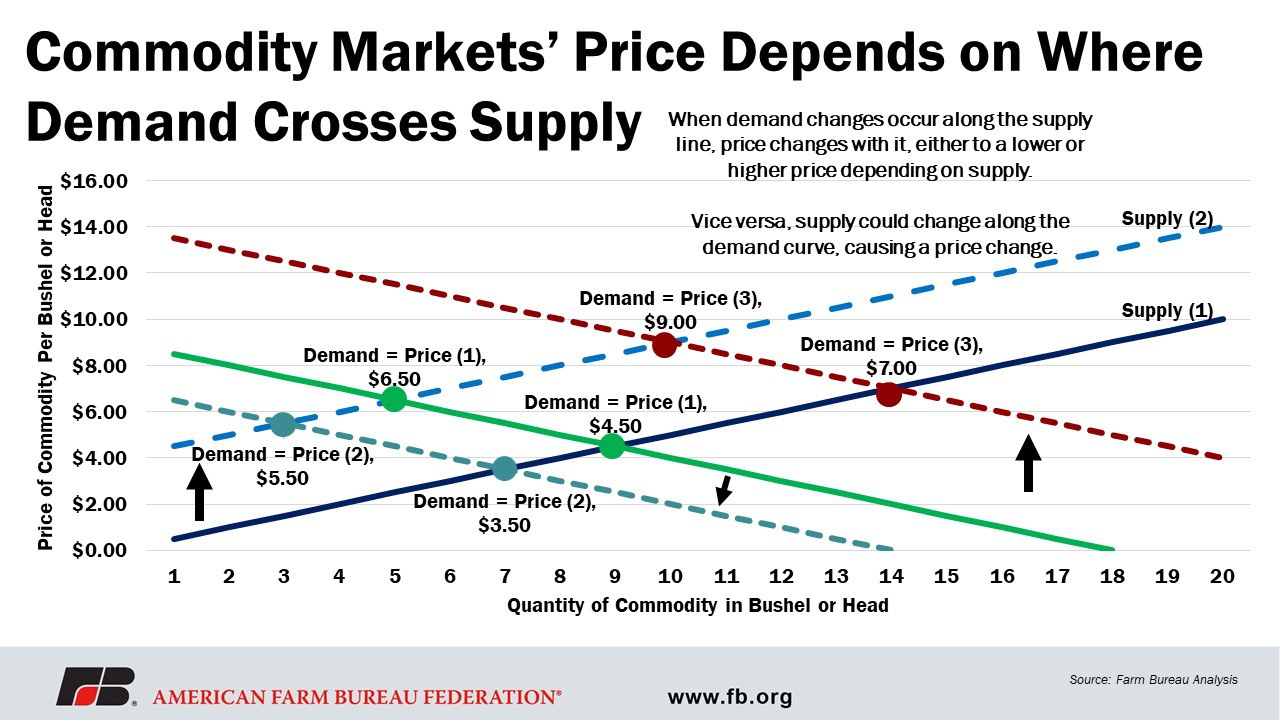

The farmer revenue equation is quite simple: the price of the commodity times the quantity of the commodity produced. When estimating a crop farmer’s revenue per acre, simply multiply the expected yield per acre by the harvest price of the crop produced. For a livestock farmer, revenue is generated for each head of livestock produced times the price received at the point of sale. Market revenues for both crop and livestock farmers vary based on price fluctuations. At the very core of economics, a commodity is an economic good that has full or substantial interchangeability, meaning it is fundamentally the same no matter who produced it and where it is produced. Given the nature of commodity markets, price is fully dependent on how much supply is in the market and what amount of demand intersects that supply point. Thus, individual farmers have no control or say in the price they receive for their commodities; farmers and ranchers are price-takers.

Production Expenses

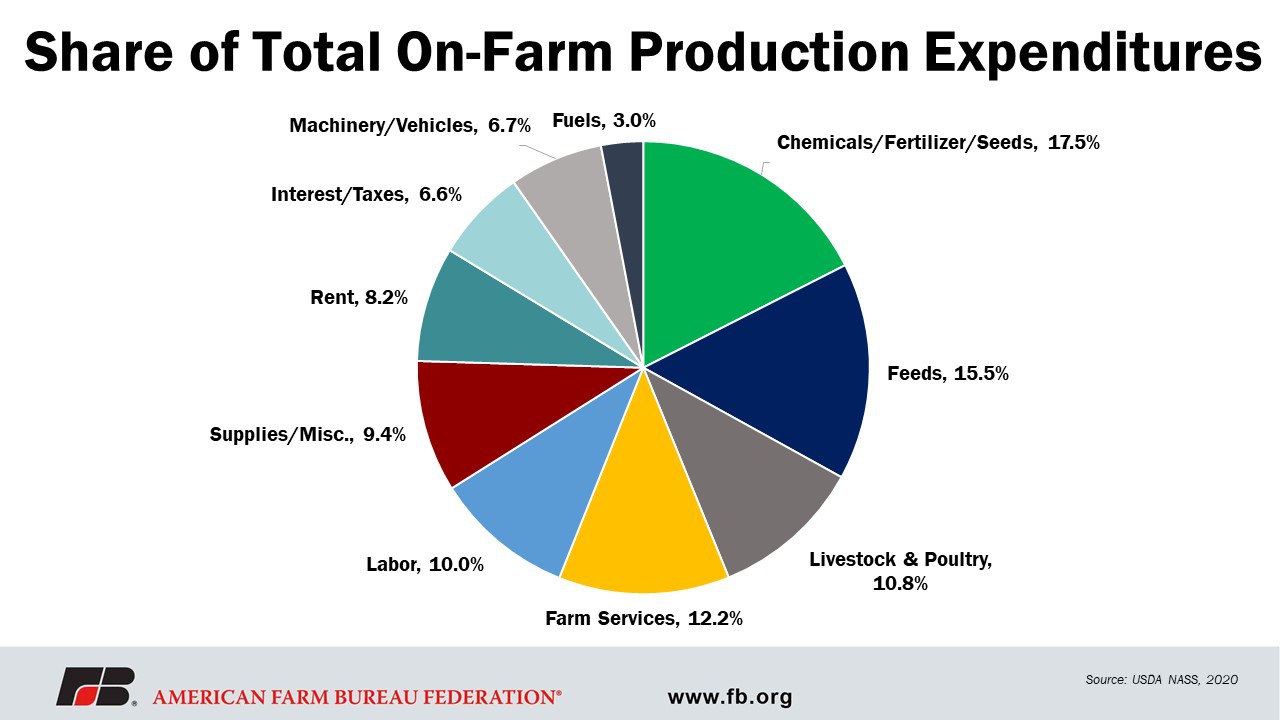

Though the revenue side of a farmer’s balance sheet may be simple, the expense side, or the cost of production, is far from simple. For farmers, production expenses cover everything from input costs, like operating costs and variable costs, to fixed costs. Input costs are the operating costs for a farm that require upfront purchases necessary to begin production. These are items such as fertilizer, pesticides, seeds, weaned animals, feed and any other production input. Variable costs are costs that will change depending on the amount of consumption on a farm or ranch and include items like fuel and oil, electricity, labor (hired and custom), repairs and maintenance, water use and storage. Fixed costs are costs that must be paid but are not dependent on the level of production. These include operator labor, machinery, taxes, asset depreciation/capital consumption, rent and interest expenses. Chemicals and fertilizer continue to make up the largest share of on-farm expenditures, up to 17.5%, while fuels remain the lowest share, representing 3% of total on-farm expenditures.

When USDA estimates net cash income, the net difference between revenues and expenses, cash expenses include feed purchased, labor, livestock and poultry, fertilizer and lime, crop seed, net rent to landlords, pesticides, property taxes and fees, fuel and oil, interest on real estate and non-real estate, electricity and other intermediate expenses. “Other intermediate expenses,” typically the largest category of expenses, includes unexpected costs, making them often the most difficult to budget for. For example, while you can expect a few unexpected events during planting season, it is difficult to estimate and budget for the planter to break down in the middle of a field and know what the repair costs plus labor could potentially be. That “other intermediate expenses” category also includes items like machine hire and custom work, marketing/ storage/ transportation of commodities, repair and maintenance, insurance premiums, irrigation and miscellaneous expenses associated with running a farm.

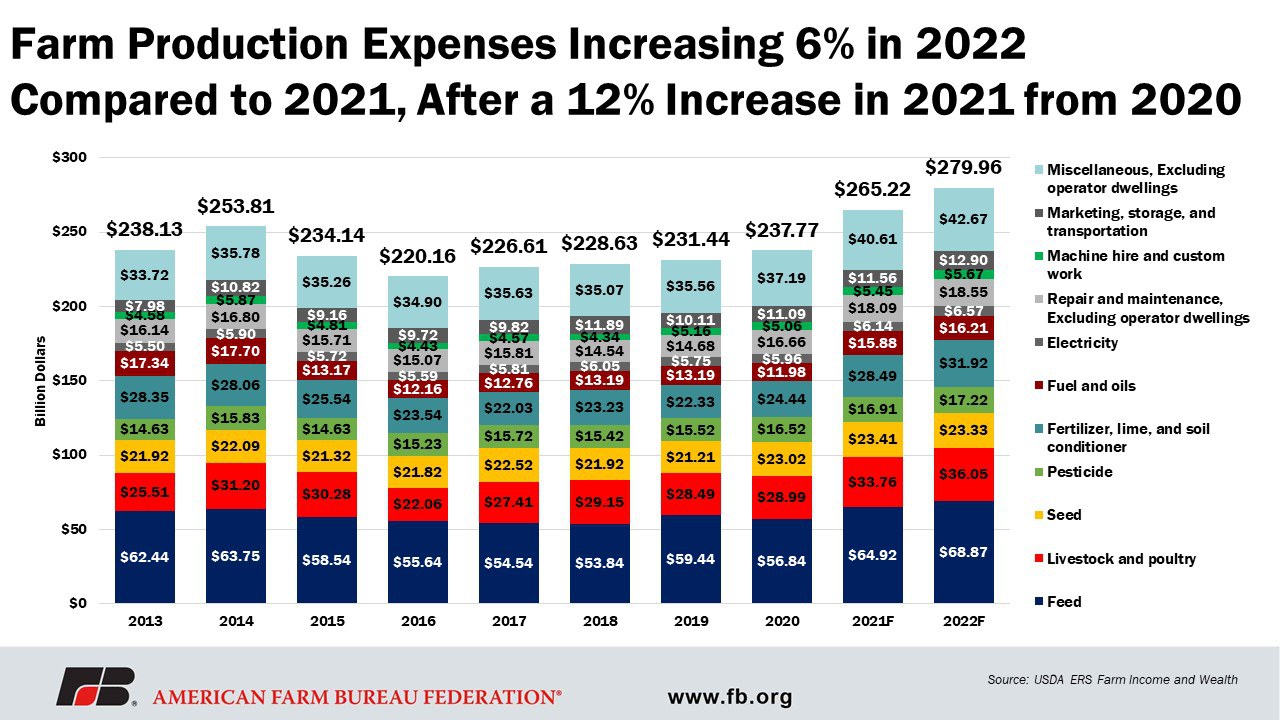

Diving deeper, USDA data is indicating that production expenses continue to rise into 2022. Just from 2021 to 2022, USDA estimates total production expenses to increase 5%; that’s after a 9% increase from 2020 to 2021. When looking closer at intermediate production expenses, like farm-origin and manufactured inputs, as well as others, this category is expected to increase 6% from 2021 to 2022, after a 12% increase from 2020 to 2021. The largest expected production expense increase in 2022 is fertilizer, increasing 12% from 2021 to 2022, after a 17% increase from 2020 to 2021. An interesting note is a potential shift away from renting ground, as rents decrease from 2021 to 2022 by 6%, and farmers transition to owning real estate, as shown by an 11% increase in real estate interest expenses from 2021 to 2022.

2022 – A Season Like No Other

Heading into the 2022 growing season, farmers are facing supply chain challenges like never before. And that’s why it’s hitting their wallets like never before, too.

To begin with, there is increased global demand to plant a crop. The global outlook for commodity production continues to increase, according to the March World Agricultural Supply and Demand Estimates. Russia’s recent military action in Ukraine significantly increased the uncertainty of agricultural supply and demand conditions in the region and well beyond. With these most recent events, there is increased pressure on all the other commodity-producing countries to deliver all of, if not more than, the expected production in 2022 to make up for any potential production lost and cut off from the market in Ukraine and Russia. With increased planted acres comes increased demand for crop inputs like fertilizer, seed, pesticides and machinery, to name a few. Not only is demand increasing for these inputs, COVID-19-related government deficit spending and loose monetary policy by central banks across the globe have put more money into circulation; these efforts to stimulate economies have also contributed to rising global inflation. Thus, expect to pay a little more for everything, including highly demanded crop inputs.

COVID-19 also disrupted labor markets and interrupted the production of goods, including crop inputs, which has led to production lagging behind demand, and the price increases that typically follow. Consumers, and farmers and ranchers in particular, used to thrive in a “just in time” delivery system. This was intended to keep inventory and overhead costs low and ensure efficient economies of scale. But now, due to those production disruptions and congested delivery channels, when farmers need their inputs just in time to put a crop in the ground, availability is not guaranteed and the price to get it keeps rising.

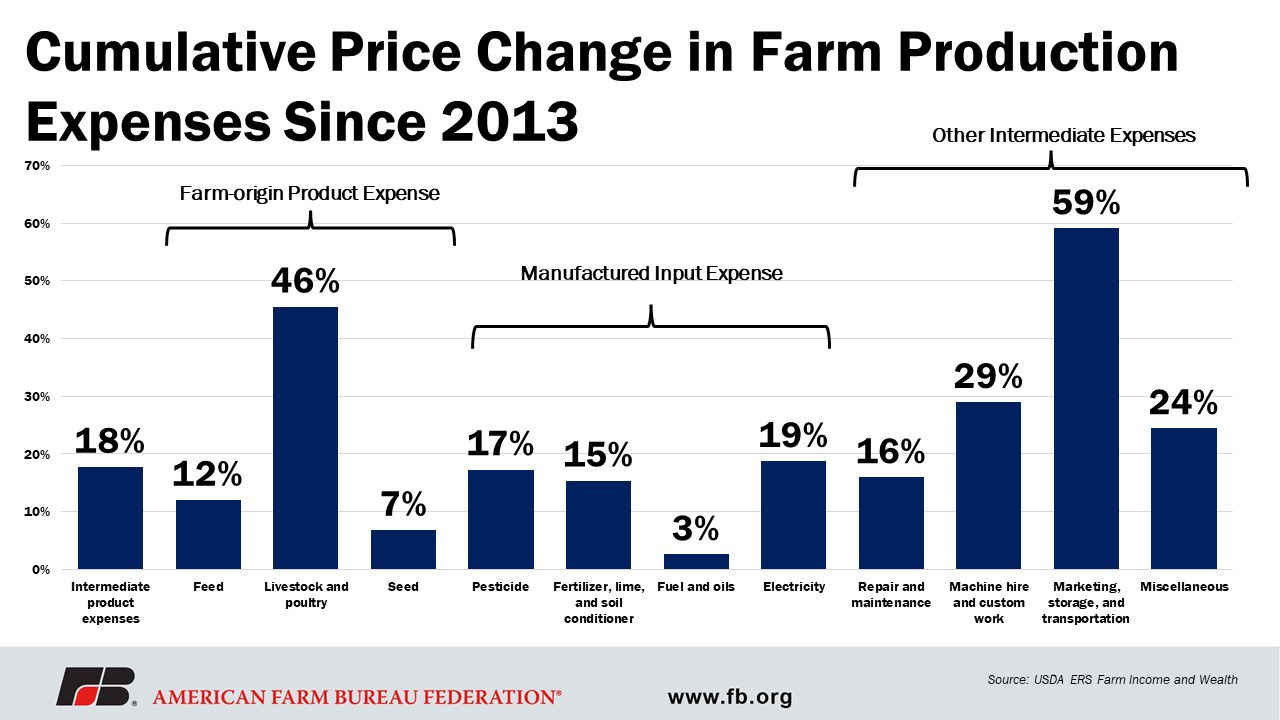

Since 2013, farmers have seen nearly all production expenses increase. Most notably, livestock and poultry farm-origin expenses have increased 46% and marketing, storage and transportation expenses have increased 59%. Overall, the intermediate expense category, which includes the majority of the farm production inputs, has increased 18% since 2013.

Summary

The ever-evolving farm business budget continues to be on the minds of all farmers and ranchers this growing season. In times of increased volatility, farmers and ranchers continue to try to find ways to make sure they can pay for all their necessary crop inputs, even as the price of those inputs continues to rise. This Market Intel article is part of a series that will explore the rising cost of production expenses like fertilizer, seed and pesticides, energy, machinery and land.

While crop revenues may be up this year, as projected by USDA, crop production expenses are rising just as quickly and could potentially outpace revenues. This is leaving many farmers to question their ability to just break even this year, despite high crop and livestock prices. While increased investment and capacity may help in the long run, in the near term, farmers are concerned about making sure they have the inputs they need to put a crop in the ground, especially at a time when the pressure to do so is rising. The question is, will they be able to afford to do so or will it be too expensive to farm?

Trending Topics

VIEW ALL