2018 Farm Bill Provides A Path Forward for Industrial Hemp

TOPICS

HempMichael Nepveux

Economist

photo credit: AFBF Photo, Philip Gerlach

Michael Nepveux

Economist

Introduction

The inclusion of hemp in the 2018 farm bill has many people — both inside and outside the agriculture sector – racing to figure out the potential market for this relatively new (well, new to the U.S., at least) agricultural product. Hemp’s proponents are growing more optimistic and vocal each year about hemp as a potential game changer for U.S. agriculture. Whether you think hemp is the next big thing, see it with more moderate potential as a new crop for farmers, or if you believe it will be a big dud, everyone can agree that farmers, policymakers and the general public are showing an increasing interest in the product.

What is Hemp?

While many people are expressing excitement, or at the very least interest, in hemp’s potential, it is helpful to take a step back and talk about what it is, and what it is not. For centuries, hemp has been a fiber and oilseed used around the world for production of a variety of industrial and consumer products. Industrial hemp is not marijuana, although it is a different variety of the same species, a fact that has at times resulted in a negative association and stymied hemp’s growth. That species is Cannabis sativa L., a substance that has historically been classified in the U.S. as a Schedule I controlled substance and regulated under the Controlled Substance Act. Since the 1990s, varieties of this plant containing low levels of delta-9-tetrahydrocannabinol, or THC, which is the ingredient that lends marijuana is psychoactive properties, have been legalized in many European countries, as well as Canada and Australia. The common threshold level of allowable THC for industrial hemp is 0.3 percent on a dry weight basis.

Industrial hemp can be grown as a seed, a fiber or a dual-purpose crop. When hemp is grown as a fiber, it is planted in a high density to maximize stalk production. The hemp plant produces an outer ring of more valuable bast fibers, and an inner ring of less valuable hurd fibers. When hemp is grown for seed, the plants tend to be spaced further apart to encourage seed production. The seeds typically contain 29 to 34 percent oil, which is similar to other oils, such as linseed.

What is in the 2014 Farm Bill and 2018 Farm Bill?

The hemp industry in the U.S. received a boost with the passage of the 2014 farm bill, which allowed “institutions of higher education” and state agriculture departments to grow hemp under a pilot program as long as state law permitted it. Additionally, the 2014 bill established a definition of industrial hemp, officially setting the THC threshold in the U.S. at 0.3 percent on a dry weight basis. At the time, all cannabis varieties were considered Schedule I controlled substances, and though the 2014 bill allowed hemp to be grown, certain aspects of production were still subject to Drug Enforcement Administration oversight, including the importation of seeds for cultivation.

The 2018 farm bill went several steps further and legalized the production of hemp as an agricultural commodity while removing it from the list of controlled substances. The 2018 bill also listed hemp as a covered commodity under crop insurance and directed the Federal Crop Insurance Corporation board to streamline the process for developing hemp policies. Given the excitement and uncertainty around the market potential for hemp, the 2018 bill also requires the secretary of agriculture to conduct a study of the hemp-related agricultural pilot programs implemented under the 2014 farm bill, along with any other agricultural and academic research on the subject, to determine the economic viability of a domestic hemp market. Additionally, while the law expands the potential for hemp production, it does not create a system in which producers can grow it as freely as other crops. The bill outlined actions that would be considered violations of the law, such as producing a plant with higher than 0.3 percent THC content or cultivating hemp without a license; it even goes into potential punishments and what happens to repeat offenders. The bill also sets up a shared state and federal regulatory authority over the issue, outlining the steps a state must take to develop a plan to regulate hemp and submit it to the secretary of agriculture for approval.

Production, Imports and Markets for Hemp

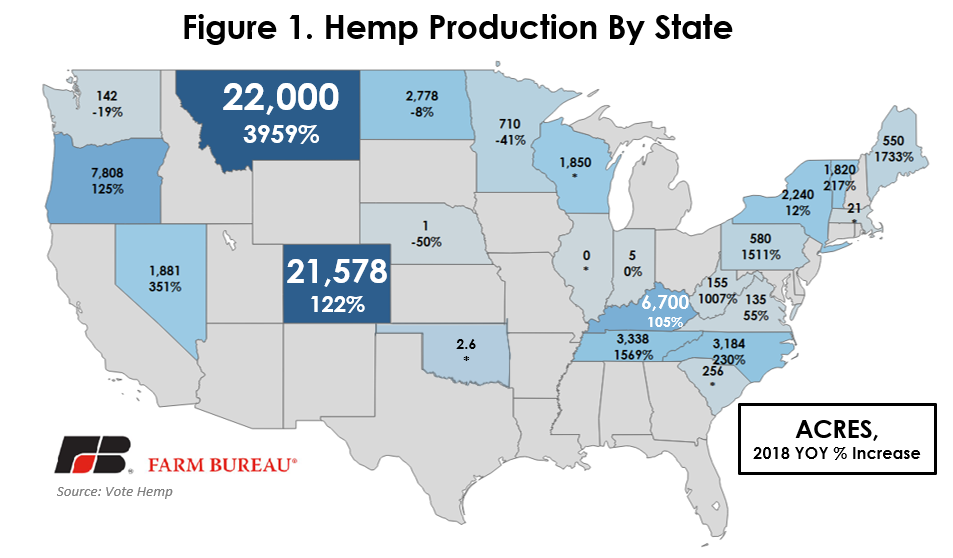

With the 2014 farm bill allowing the production of hemp under specific conditions, hemp production in the United States has begun a sharp upward march. No official estimates of hemp production are available at this time, but private estimates show that although the overall acreage is modest, the growth rate is very strong. Vote Hemp, an organization that promotes hemp in the marketplace, estimates that in the last three years hemp acreage has increased from 9,800 in 2016, to 26,000 in 2017, to 78,000 acres in 2018.

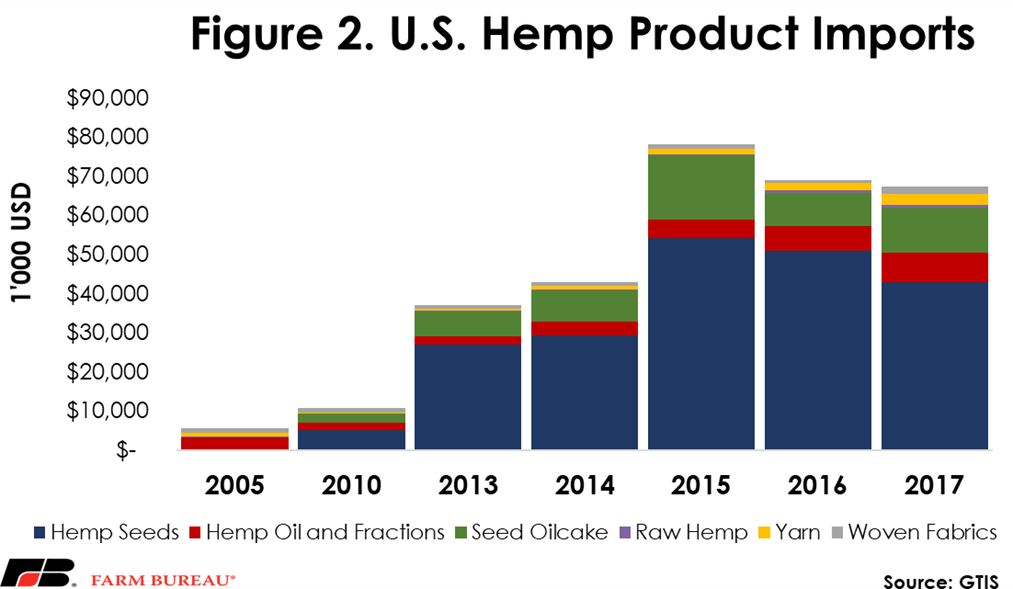

Over the past few decades, hemp imports have been growing, reaching a high of nearly $80 million worth in 2015, before declining to just under $70 million worth in 2017. Nearly two-thirds of the value of hemp imports was derived from hemp seeds. As is the casewith many U.S. imports, Canada is the largest supplier of hemp to the U.S., accounting for as much as 90 percent.

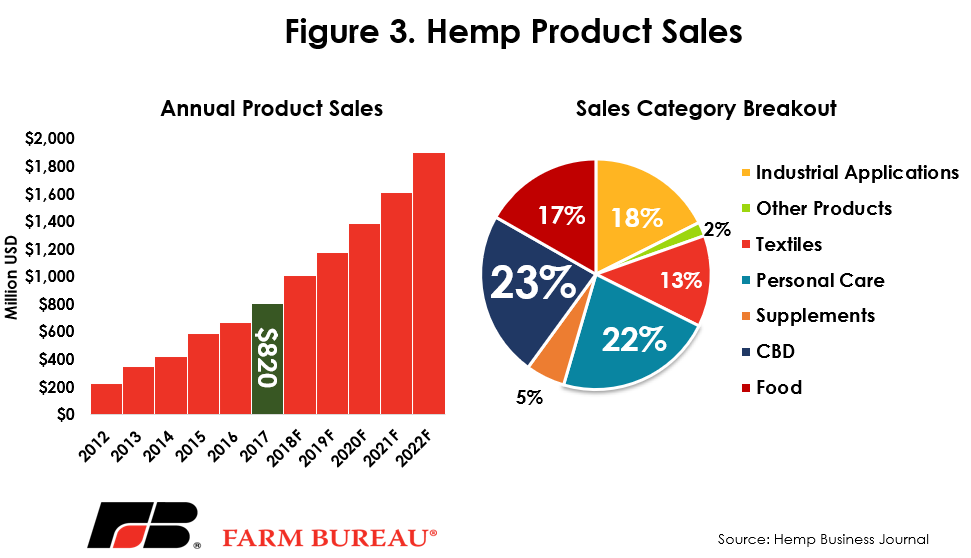

While some claim there could be as many as 50,000 various uses for hemp products, there may be only a few products with the potential to generate a significant market, with the major categories being fiber, oilseed and pharmaceuticals. Not much official data exists on the value of retail sales of hemp-based products in the U.S. Hemp Business Journal estimated 2017 U.S. hemp sales at $820 million, an increase of 19 percent over 2016’s estimated $688 million in sales. There have been many feasibility and market studies conducted by universities and USDA, and most researchers acknowledge industrial hemp as a potentially very profitable prospect. At the same time, these researchers note the uncertainty surrounding that potential market, much of it stemming from the general lack of information and research.

The markets for bast fibers, such as industrial hemp, include specialty textiles, paper and composites. Hemp fibers are used in textiles, fabrics, yarns, paper, carpeting, insulation, construction materials and even auto parts. Hemp seed and oilcake are used in various foods and beverages, including salad and cooking oil. Hemp seeds are crushed for their oil, producing hempseed oil, which is used in soap, shampoo and cosmetics. Other various uses of industrial hemp include hempcrete (a mixture of hurds and other products), which is used as a building material, and composites for use as a fiberglass alternative for the auto and aviation industry.

One of the biggest potential markets for hemp products is cannabidiol, or CBD. CBD is a non-psychoactive compound in cannabis that is low in THC. CBD is generally marketed as relief for various illnesses and symptoms such as epilepsy, post-traumatic stress disorder, nausea and other disorders. There is some concern that some products derived from industrial hemp, such as hemp oil, are being marketed as having comparable therapeutic uses to CBD extracts, but this issue is unresolved. However, research into potential uses for industrial hemp-derived CBD products is an important area being investigated. Unfortunately, there is still uncertainty surrounding the 2018 farm bill’s impact on the regulation of CBD.

What are Some of the Challenges?

Regulation: Uncertainty still exists about how and when regulations in general will be implemented and what those regulations will look like. There are also still many unknowns about the regulation of CBD as a Schedule I substance. On Feb. 27, Secretary Perdue testified before the House Agriculture Committee that USDA is proceeding slowly and carefully in working on the multiple rules required for hemp production. Secretary Perdue indicated that it will likely not be until the 2020 planting season that the department has definitive rules in place. Until the 2018 bill is implemented and clear rules are in place, there are still nine states that have not legalized the cultivation of hemp under the previous farm bill law: Connecticut, Georgia, Iowa, Idaho, Louisiana, Mississippi, Ohio, Texas and South Dakota. Once the new federal process is in place, each state will likely need to submit a plan for approval before farmers in those states can produce hemp. Concerning CBD, the question about the classification of CBD as Schedule I appears to be somewhat in limbo. The 2018 farm bill removed hemp and hemp-derived products from Schedule I status, but there is still much CBD produced from plants that are above the 0.3 percent threshold and it is unclear how CBD in general is going to be treated. FDA made it clear that the 2018 bill did not impact the agency’s regulatory authority over CBD and other hemp-derived products used in food and drugs. FDA will be hosting a public meeting to gather input from stakeholders on the development of policy regarding the regulation of these products.

Crop Insurance: Uncertainty also exists over how hemp will be treated under crop insurance in the near future. Fortunately, USDA’s Risk Management Agency issued a bulletin on Feb. 25 addressing some of the questions about how hemp will be treated now that it is covered in the 2018 farm bill. The bulletin established that a producer who derived part of his revenue from hemp (as defined in the 2018 farm bill), would not be found ineligible to participate in the Whole Farm Revenue Protection Plan. In the past, since hemp was classified under Schedule I, if any revenue of the operation came from a Schedule I substance, the producer would be ineligible for all insurance under that policy. Unfortunately, since hemp was classified as a Schedule I substance when the 2019 WFRP was published in August 2018, hemp as a commodity is not insurable in 2019. This means that a producer can grow hemp in 2019 without becoming ineligible to insure their other commodities but cannot have that hemp insured under WFRP. In 2019, there is no safety net for this crop. So, producers who get into the game must understand that they could lose their investment in the crop if it fails. Most observers think that in 2020 hemp will be a covered commodity for crop insurance, but questions still remain. For example, let’s say a farmer enrolls his hemp crop in crop insurance, but then the crop goes over the 0.3 percent limit required by law and the farmer has to destroy the crop. Would that be a covered loss?

Supply Chain: Because industrial hemp production had been illegal in the U.S. prior to the 2014 farm bill, procuring the seed used to grow hemp has been a challenge. Since other countries have had legal production for a few decades now, most of the seeds come from Canada and Europe. Additionally, downstream processing for hemp and hemp-derived products has a long way to go in terms of developing the supply chain in the U.S. Even if the consumer demand for a product is there and farmers are growing the crop, the supply chain link between the farmer and the consumer needs to have capacity to process and develop the product. This will likely take some time.

THC Threshold and Genetics: Since most of the seeds used to produce hemp have been imported from other countries, the U.S. still doesn’t have a very long history of research into how some of these seeds acclimate to this climate. If a farmer brings in seed from Europe, and the hemp crop tests at above the 0.3 percent THC at harvest, then that crop becomes illegal and must be destroyed. This is likely more of a short-term issue as producers and researchers develop a better understanding for how different genetics express themselves.

Closing thoughts

Hemp as an agricultural commodity could be an exciting game changer, but there are no guarantees. Some pro-hemp activists have cultivated the idea that the hemp market already is poised to take off and become massive, while ignoring the many challenges still facing the industry. In the U.S. hemp still is very new, and with the potential it offers comes issues such as developing the supply chain, branding the product, educating consumers and policymakers, developing end markets and a host of other challenges. Additionally, there is a great amount of uncertainty surrounding the hemp market in general, as well as in the policy and regulatory arenas. There certainly are great possibilities for hemp in the U.S., but the industry is still at square one, and has a lot of hard work ahead of it.

Trending Topics

VIEW ALL